The proof of life

Federal Pension Office - Life insurance certificates

If you live abroad and receive income from Belgium (e.g. a pension), you should take into account that you still have administrative and tax obligations towards Belgium. Failure to keep these obligations in order entails a risk of cancellation or cessation of your income.

What is the proof of life?

Pensioners who receive a benefit from the Federal Pension Service (FPD) and who are not domiciled in Belgium must submit a life certificate every year. This form must be returned to the Pension Service within 30 days of receipt (by post or via www.mypension.be). If not, you risk having the payment of your pension suspended.

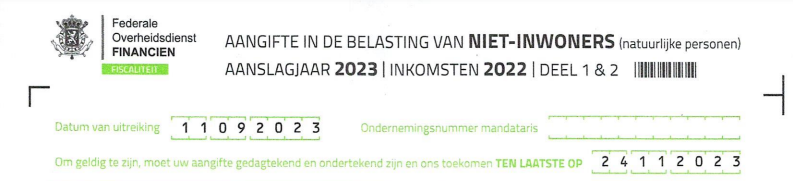

Keep in mind that if you receive a pension from Belgium, you must also submit an annual declaration in the BNI - Tax Declaration of Non-Residents (Belgian non-resident with a form of income from Belgium).

Why should you do this annually?

You have to do both administrative tasks every year because the FDB is not automatically informed by the foreign services of any change in your place of residence, civil status, nationality, death, etc.

How do you fix this?

- Date and sign the front of the form.

- As a Belgian national, you have the reverse side of that form filled in by either:

- The Belgian Embassy of the country where you reside

- The Belgian consulate of the country where you reside

- The local competent authorities; town hall, mayor, police, ...

- If you are recently married, divorced, remarried, a widow/widower - you need to add a certificate of this

- Send the form to the Federal Pension Office

What can Segurantis do for you?

Go to the overview of our services.

Related Posts