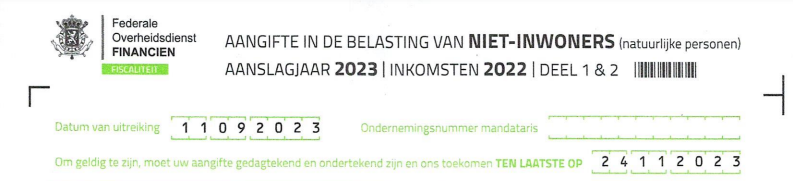

Income from Belgium? Don't forget the declaration in the Tax NON-INVIRONERS

The "Non-Resident Income Tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the return for individuals who do not have a tax residence in Belgium, but do (or do not) receive taxable income from Belgian sources.

The specific rules and rates may vary depending on the type of income (for example: income from real estate located in Belgium, income from employment in Belgium, pensions, benefits, etc.). Certain exemptions or reductions may also apply, depending on bilateral tax treaties between Belgium and other countries. In short, every euro that leaves Belgium and is sent to your bank account must be declared, and that applies to ANYONE.

Keep in mind that the last day to file this return is 24/11 of the current calendar year. Failure to complete it may result in penalties and even the deletion of income.

If you have specific questions about the GNI non-resident tax in Belgium, such as rates, deductions, or how to declare this tax, I recommend that you contact a Belgian tax advisor or the Belgian tax authorities for the most up-to-date information: email to tax.belgium@minfin.fed.be or call 0032 2 572 57 57.

Related Posts