CRS - Common Reporting Standard

What's the CRS?

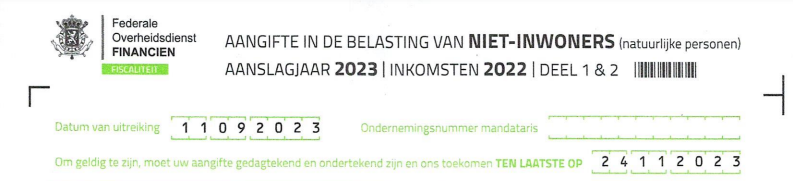

If you have a bank account abroad and you live in a country such as Belgium, the Netherlands or Spain, you are obliged to communicate the details of your foreign financial institution to the tax authorities via your annual personal income tax return. This is because the country of residence has the right to know where you have parked your funds or where you simply have an account for daily purchases when you are on holiday.

As a good citizen you indicate this of course, but suppose you have forgotten this then there is a higher level organization - control system that keeps an eye on this for you. This is called the Common Reporting Standard.

Legal basis

The CRS is fully legal and originated from an EU Directive on 15 February 2011 and has been subject to some substantial adjustment in 2016. The aim is to improve administrative cooperation in the field of taxation between countries.

Failure to declare your foreign accounts, whether you do so intentionally or have forgotten, is equivalent to withholding information that you are required to declare. Fines and tax increases may result from not disclosing this information.

Related Posts