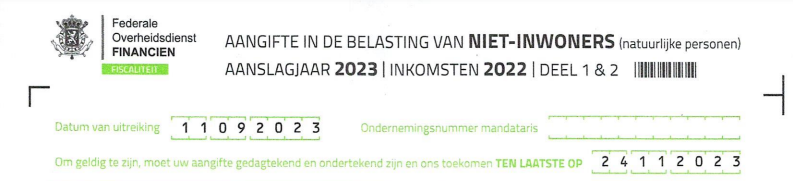

IBI - 2022

If you are a non-resident in Spain and you own property (-men), you must file the non-resident tax return(model 210). This tax declaration/obligation must be done once per calendar year and is calculated on the number of days you owned the previous calendar year. The declaration must be filed and paid between January 01 and December 31.

Depending on the value of the property (calculated on the cadastral value) you will have to pay a corresponding tax, the annual non-resident tax. So this is NOT the IBI or SUMA, the IBI or SUMA is a land registry tax that must also be paid annually and is levied on the property itself. The non-resident tax is a tax that affects the owner(-s) of the real estate (real estate = house, garage, shed, ... anything with a cadastral reference).

Each owner must make this declaration accordingly according to his % share owner. For example a married couple is usually 50%-50% owner, so 2 declarations. If, for example, you have 4 owners (2 parents and 2 children who each own a share) then you will have to make a declaration according to the proportion of your property in the whole. This declaration is then made per head per property (the more property you have as a non-resident, the more declarations you will have to make and pay the tax due on it).

It happens in many municipalities that at the same time as the IBI assessment they also send an assessment for paying the tax for the collection of garbage (recogida de basuras). In addition, owners of parking lots may receive a separate assessment for the cadastral value of that parking lot or you may receive a separate assessment for having plants in your garden.

So you no longer need an intermediary to pay this tax. Many law firms or gestors charge you extra to keep this in order for you while this can be paid automatically. The IBAN standard for payments across borders allows you to perfectly automate this sum through your bank account in your place of residence, one more reason to stop the usually high-cost bank account in Spain.

Segurantis can take care of this and if you wish please let us know.

Related Posts