The "non-resident GNI tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the...

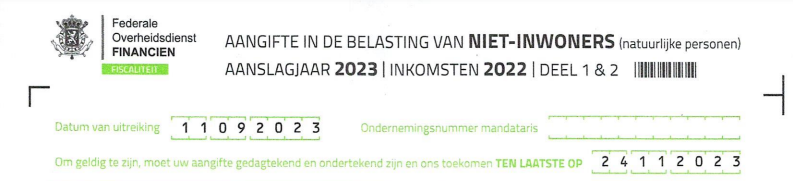

Income from Belgium? Don't forget the declaration in the Tax NON-INVIRONERS

The "non-resident GNI tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the...

Who is subject to this? You have income of Belgian origin You no longer officially live in Belgium because you have deregistered from your municipality but you still receive...

You live abroad (not in Belgium) and you have/receive income from Belgium (e.g. a salary, a pension, rental income) => You have to file a "non-resident tax return"...

The Spanish personal income tax declaration period is over. The last day to submit the declaration within the legal deadline fell on 30 June of this calendar year....