The "non-resident GNI tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the...

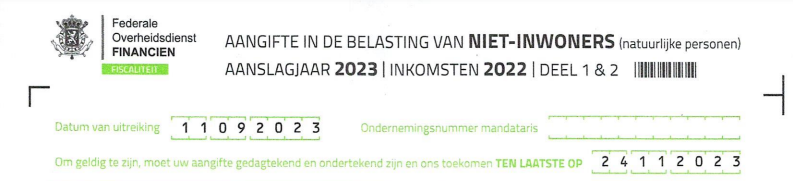

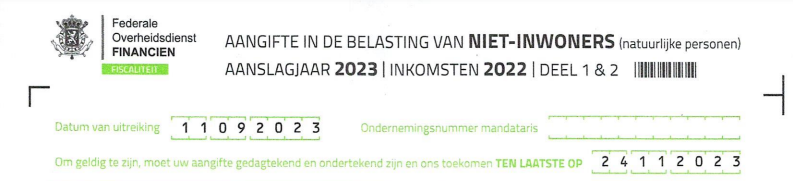

Income from Belgium? Don't forget the declaration in the Tax NON-INVIRONERS

The "non-resident GNI tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the...

GNI, or "Non-Resident Tax," in Belgium is a tax levied on the income of non-residents who receive certain income from Belgium. Unlike residential taxpayers, who...

Every owner of a property in Spain (a home, garage, shed, plot of land,...) must pay the annual property tax, better known in Spanish as the Impuesto sobre Bienes Inmuebles...

The annual returns model 100 and model 714 If you live in Spain then you have undoubtedly heard of model 100 and / or model 714. Both models are in fact...

Since 2021, holiday rentals must now also have an energy label Since 1 June 2021, it is mandatory to have an energy label for holiday rentals in addition to a rental licence. Are you...

The Spanish taxman is getting his money's worth Whoever has invested in crypto currencies will probably have a good 2020 behind them. The prices rose sharply in 2020 and also...

Spanish wealth tax applies to residents If you are a permanent resident in Spain and have assets of at least 500,000 euros, it is best to take...

The Spanish personal income tax declaration period is over. The last day to submit the declaration within the legal deadline fell on 30 June of this calendar year....

Do not forget your Spanish tax obligations as a resident We inform you that the files for the submission of the annual Spanish Personal Income Tax are closed. Clients who have not yet received...

From 6% to 8% In 2021, the Spanish government has decided to increase the tax they levy on any insurance taken out from the 6% to the 8%. This is...