The "non-resident GNI tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the...

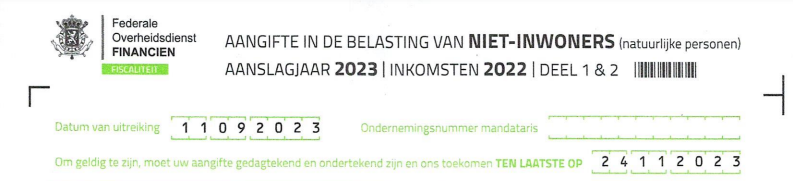

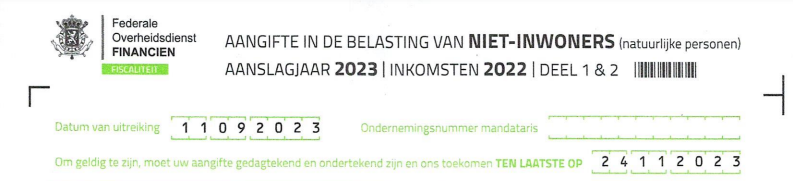

Income from Belgium? Don't forget the declaration in the Tax NON-INVIRONERS

The "non-resident GNI tax" (GNI) refers to the tax levied on the income of non-residents of Belgium who generate income in Belgium. In other words, it is the...

GNI, or "Non-Resident Tax," in Belgium is a tax levied on the income of non-residents who receive certain income from Belgium. Unlike residential taxpayers, who...

Every owner of a property in Spain (a home, garage, shed, plot of land,...) must pay the annual property tax, better known in Spanish as the Impuesto sobre Bienes Inmuebles...

If you are a non-resident in Spain and you own property (-men), you must file the non-resident tax return (model 210). This tax declaration/obligation must be done once per calendar year and...

If you come to settle in Spain then you will have to follow some laws, at least if you want to be in order. A general rule that applies within the EU,...

If you are a non-resident in Spain and you own property (-men), you must file the non-resident tax return (model 210). This tax declaration/obligation must be done once per calendar year and...

If you are a non-resident in Spain and you own property (-men), you must file the non-resident tax return (model 210). This tax declaration/obligation must be done once per calendar year and...

To whom does this obligation apply? The wealth tax or Model 714 taxes the total assets of a taxpayer if they exceed a certain value. That is, the worldwide value of...

The annual returns model 100 and model 714 If you live in Spain then you have undoubtedly heard of model 100 and / or model 714. Both models are in fact...

The cadastral value is formed by adding the sum of the land value and the building value of the property.